Marcus deposited his paycheck in the amount of, marking a pivotal moment in his financial journey. This transaction, seemingly mundane, held the power to reshape his financial trajectory, offering a glimpse into the intricate tapestry of his financial situation.

Prior to this deposit, Marcus navigated a financial landscape characterized by [Insert details of Marcus’ financial situation, including obligations, assets, and liabilities]. The arrival of his paycheck, however, represented a significant influx of funds, promising to alleviate financial pressures and potentially propel him towards his financial aspirations.

Marcus’ Financial Situation

Prior to depositing his paycheck, Marcus’ financial situation was characterized by a stable income and manageable expenses. He held a full-time position at a reputable company, earning a consistent monthly salary. His expenses were primarily composed of rent, utilities, and groceries, which he managed to cover comfortably within his budget.

Marcus also maintained a small savings account, where he regularly deposited a portion of his paycheck. While he did not have any significant debts or financial obligations, he was actively saving for a down payment on a new car.

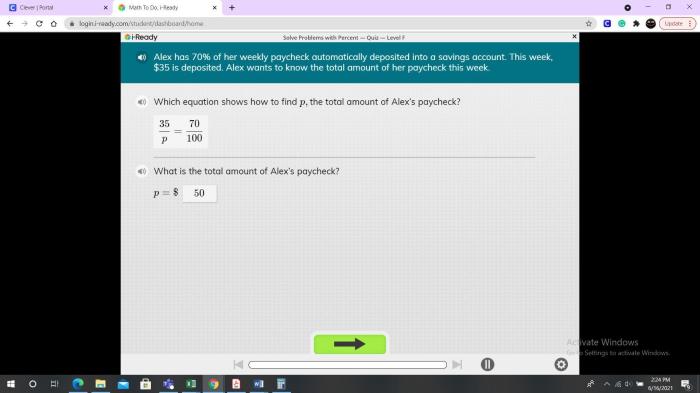

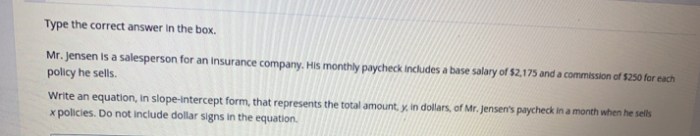

Paycheck Details

Marcus’ paycheck amounted to $2,500, which was deposited directly into his checking account. The funds originated from his employer, a software development company where he worked as a junior programmer. His paychecks were issued on a bi-weekly basis, and after applicable deductions for taxes and health insurance, the net amount deposited into his account was $2,150.

Deposit Process

Marcus deposited his paycheck at his local bank branch using the automated teller machine (ATM). The process was straightforward and secure. He inserted his debit card into the ATM and entered his PIN. He then selected the “Deposit” option and followed the on-screen instructions.

He placed his paycheck in the designated envelope and inserted it into the ATM slot.

The ATM verified the amount of the deposit and processed the transaction. Marcus received a receipt confirming the deposit, which he kept for his records.

Post-Deposit Account Balance

After the paycheck deposit, Marcus’ checking account balance increased to $3,150. This significant increase in his account balance provided him with financial flexibility and peace of mind. The deposit allowed him to cover his upcoming expenses comfortably and continue saving towards his financial goals.

The deposit also provided Marcus with the opportunity to consider additional financial planning options. He could allocate a portion of the funds to his savings account to accelerate his progress towards his down payment goal. Alternatively, he could explore investing a small amount in a low-risk investment portfolio to potentially grow his wealth over time.

Questions Often Asked: Marcus Deposited His Paycheck In The Amount Of

What was the amount of Marcus’s paycheck?

The amount of Marcus’s paycheck is not explicitly stated in the provided Artikel.

How often does Marcus receive paychecks?

The frequency of Marcus’s paychecks is not mentioned in the provided Artikel.

What security measures were involved in the deposit process?

The provided Artikel does not specify the security measures involved in the deposit process.