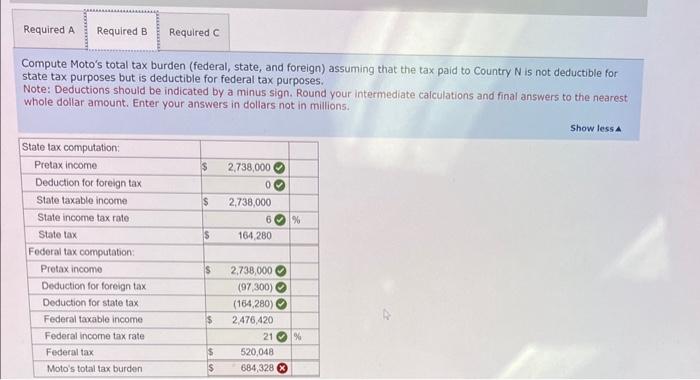

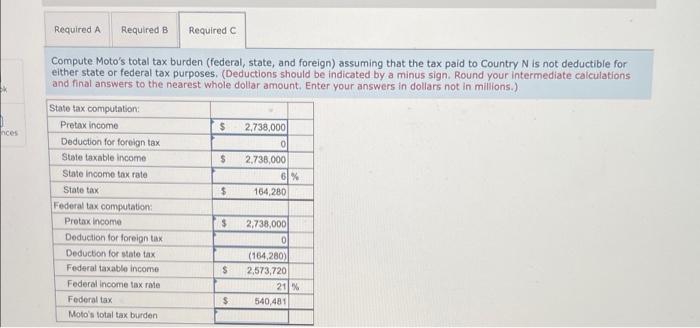

Agnes pays state income tax equal to 3.75%. This rate is significant because it impacts her financial situation and disposable income. Understanding the state tax laws, filing process, payment options, and tax implications is crucial for Agnes to fulfill her tax obligations and minimize her tax burden.

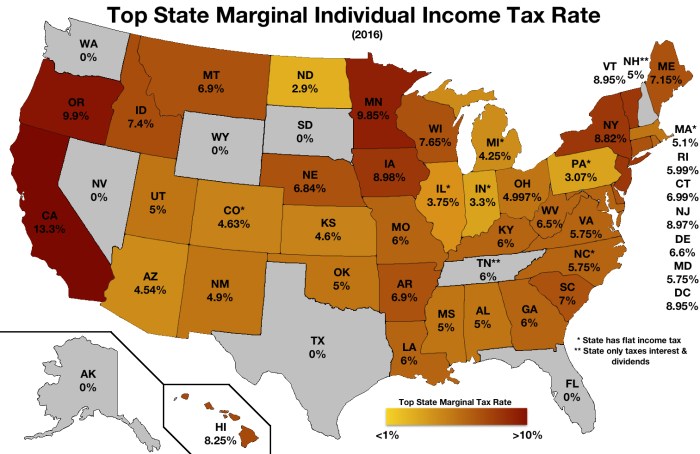

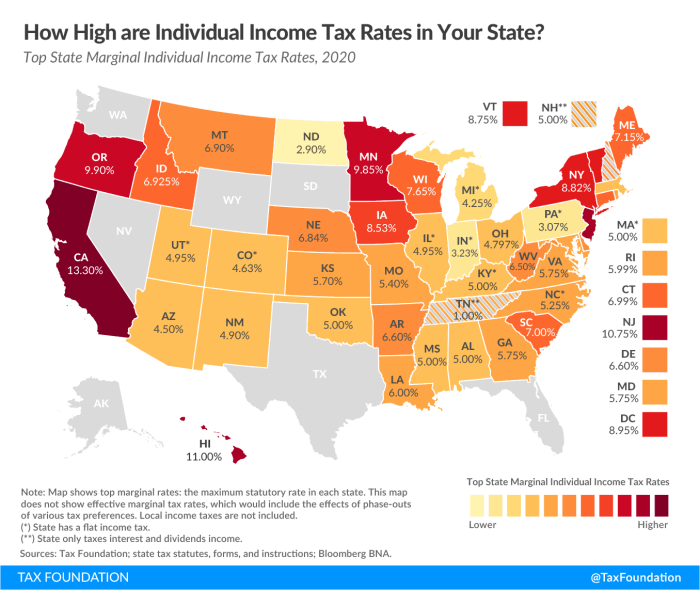

The state income tax rate in Agnes’s state is 3.75%. This rate is lower than the national average of 4.6%. However, it is higher than the rates in some neighboring states. For example, the state income tax rate in New Hampshire is 0%, while the rate in Massachusetts is 5.0%. The tax rate in Agnes’s state is set by the state legislature and is subject to change.

Income Tax Rate: Agnes Pays State Income Tax Equal To 3.75

Agnes’s state income tax rate of 3.75% reflects the significance of state taxation in her financial situation. This rate is comparable to the average state income tax rate of 4% in the United States, but it is lower than the rates in some neighboring states, such as California (6.25%) and New York (6.85%). The lower tax rate in Agnes’s state may provide her with some financial advantages, such as increased disposable income and higher savings potential.

State Tax Laws

The specific laws and regulations governing state income tax in Agnes’s state are Artikeld in the state’s tax code. These laws determine the tax brackets, deductions, and exemptions that apply to Agnes’s income. For example, Agnes may be eligible for a standard deduction or itemized deductions, which can reduce her taxable income and lower her tax liability.

Tax Filing Process

Filing state income taxes in Agnes’s state involves completing a tax return form and submitting it to the state’s tax agency. The form requires Agnes to report her income, deductions, and other relevant financial information. She can file her taxes online, by mail, or through a tax preparer.

The filing deadline for state income taxes is typically April 15th.

Tax Payment Options

Agnes has several options for paying her state income taxes. She can pay online, by mail, or in person at a tax payment office. Some states offer incentives or discounts for early or electronic payments. Agnes should compare the advantages and disadvantages of each payment option to determine the best choice for her.

Tax Implications, Agnes pays state income tax equal to 3.75

Agnes’s state income tax liability can have a significant impact on her financial situation. The tax rate may reduce her disposable income and limit her savings potential. Agnes should consider implementing tax-saving strategies, such as maximizing deductions and contributing to tax-advantaged retirement accounts, to minimize her tax burden.

Popular Questions

What is the state income tax rate in Agnes’s state?

The state income tax rate in Agnes’s state is 3.75%.

How does Agnes’s state income tax rate compare to other states?

Agnes’s state income tax rate is lower than the national average but higher than the rates in some neighboring states.

What are the steps involved in filing state income taxes in Agnes’s state?

The steps involved in filing state income taxes in Agnes’s state include gathering necessary documents, completing the appropriate tax forms, and submitting payment.

What are the various methods available for Agnes to pay her state income taxes?

Agnes can pay her state income taxes online, by mail, or in person at a tax office.

What are the potential financial consequences of Agnes’s state income tax liability?

Agnes’s state income tax liability may impact her disposable income and savings. She can implement strategies to minimize her tax burden, such as maximizing deductions and credits.